How I prepared for my CFA L2 exam

It’s now almost the end of 2021, and nearly a year has passed since I passed my CFA L2 exam. At the time, I made a simple light-hearted take with 15 bullet points I had taken away from that experience (see below).

Thinking to myself this time ethics was going to be different, but it turns out I frankly still found it as confusing as level 1 and I was reminded why I like numbers > words

Wondering how the heck I was going to remember all the formulas in derivatives, equities, fixed income (notwithstanding the other topics but those 3 mainly), and alas I didn't remember them all going into my exam anyway...

Seeing kids on Wall St Bets post gains that were stronger than my own portfolio and sometimes chuckling to myself why I was even bothering with my CFA exam

Mark Meldrum (i.e. MM, my 3rd party prep provider I use to study) calling out a part of the textbook relating to mathematically calculating economic income as nothing but an exercise for the academic to show off (i.e. "academic masturbation")

MM going on a long ramble about lawyers, and the misery they cause in alternative investments, and nodding along to all the facts he spouts, but then I wake up and remember I have friends in law

MM explaining the difference between "equal" and "equitable" in ethics, and questioning myself as to whether people see me as nothing but a dirty capitalist

The moment you get a >75% in a topic of the CFAI's quiz bank :')

Staring out my home window asking why I was torturing myself and not seeing friends, only to remind myself this was all just a trade off that was part of the CFA program for 1-2 months before my exam

Wondering to myself why the CFAI's answer to post recession winning stocks, is value > growth, when I see growth > value playing out in 2020 (but patting myself on the back and not taking the textbook as gospel)

Received my email telling me my original Jun 2020 exam was cancelled due to COVID and thinking God had just bought me more time

Realising I succumbed to my temptations post exam cancellation and wasted 1-2 months slacking off and losing all the momentum I had built

Needing my boss at work to give me the serious pep talk to get my act together and "get it over and done with" because I had reservations about doing the exam in Dec 2020 because of fears it could get cancelled again, but tough love often works right?

Being all calm, but eventually the volume of content in CFA level 2 program hits you and you realise you need to be cramming 3 hours a day of study at least, which can be done, but just gets a little complicated when you find it difficult shutting off thinking about your stocks at your fund

Doing a 6 hour exam wearing a face mask and being glad I can come out saying it can be done (and using the drinking water excuse just to take the mask off momentarily to get fresh air in the exam)...

Concluding to myself that after all my business studies since 2015, that you make money by buying low and selling high...

I did intend on following that up with a more serious post about how I studied and what I think helped me pass on my first attempt in this exam.

This is only my personal experience that I am sharing, but I am hoping it can be a guide to other future students who may be attempting the CFA L2 exam. I figured this was worth writing because many students have asked about my experience in the CFA L2 exam.

There are lots of good resources already out there on people sharing their experiences and I figured I would share my 2c.

Let’s just acknowledge the elephant in the room which is the historic pass rates of the CFA exams, from level 1, 2 and 3 (courtesy of 300 Hours) over the last ~10 years. Call it the “COVID” effect or whatever, but the last few data points show a much lower passing rate than the historical average over the last ~10 years.

One of my mentors (Joey), has always helpfully reminded me of the behavioural biases that we all have as humans. We all fall victim to cognitive errors and emotional biases. I think one of the ones I had historically in the past was the “planning fallacy” (by Kahneman and Tuersky). There’s a great book called “Thinking, Fast and Slow” by Daniel Kahneman which I would recommend people to read if you’re more interested in this topic.

Predictions about how much time will be needed to complete a future task tends to display an optimism bias. In other words, we tend to underestimate the time needed to complete something in the future.

I studied on average ~20 hrs a week from early July to the end of November. Let’s say for ~5 months, then that totals to ~360 hours of study for the L2 exam. Sounds about right. The typical CFA candidate studies on average ~300 hours for their exam according to the CFAI (CFA Institute), but frankly I think that is a grossly conservative number. I think the actual number for passing candidates is more like ~400 hours at least.

Balancing full-time work and CFA L2 exam study is a delicate balance. Particularly if you’re working likely 50-60 hours per week in a hedge fund, but I would say I’ve likely weathered that transition of study and work simultaneously since my early days studying commerce at UNSW and working at Deloitte as a cadet. I would encourage others to be aware of this transition if they’re not used to working and studying at the same time. That takes a lot of self-discipline.

The reality is, the CFA L2 exam is a step up in difficulty from the CFA L1 exam.

The CFA L2 exam is unique from L1 in that this is the first time you see “vignettes”, which are basically “case study” type questions, and you may get several sub-questions per vignette. Here’s a good example from the CFAI.

In L1 you were accustomed to just seeing each question standing on its own as a unique question. L2 emphasises absorbing a “story” and then answering several Qs that may be related together in some way.

However, this is nothing new if you’ve gone through an undergraduate degree. I recall seeing exams where they’d give you a block of text, and then ask several questions on it. A good example was my time at UNSW studying the auditing course (i.e. ACCT3708).

The other way I compare L2 to L1, is by looking at Bloom’s taxonomy of learning. Typically, L1 is an exam that is all about “remembering” and that generally can get you past the L1 exam. I’d say like ~50% of the exam are questions you can get by with simply remembering something you read in the syllabus. The other 50% starts to touch on the “understanding” layer but clearly, you can see the exam is not demanding on “thinking skills” at L1.

However, L2 is 1-2 steps above in the pyramid, with a much greater emphasis on “applying” and “understanding”, rather than simply remembering. I would say ~90% of the exam is focused on the former 2 words, and the latter is now only 10% of the exam.

Mark Meldrum (who I’ve used as my CFA exam prep provider in L2 and L3) shows a really good example of a Q that attempts to show the difference in the orders of thinking skills you would expect to see from L1, to L2, to L3.

So let’s use some simple year 7 biology to show the difference in L1 and L2 of the CFA exam…

This is an example of a basic L1 exam question. You could just vaguely remember the word “photosynthesis”, circle it, and move on with your life. You don’t even need to know what we mean by photosynthesis… This question doesn’t demand much at all.

For this L2 example question below, you cannot memorise or remember your your way through a question. You would actually need to understand what “efficiency” means to answer the question. I think the answer is nuclear by the way.

Another type of L2 exam is the one below, which is much more about applying the knowledge of your science to this question below. You cannot memorise your way through an exam Q like this, since you’re required to use the information provided to you.

For those interested in going into the higher levels of Bloom’s taxonomy of learning (e.g. what are the types of Qs you would expect to see in the L3 exam), Mark Meldrum does a good breakdown here.

So recognising that the L2 exam requires higher-level orders of thinking is first and foremost the most important thing to recognise, and thus simply memorising the syllabus from the CFAI is not a good strategy to passing (which may have worked in L1). As such, it’s clear you’re likely spending more study time to do L2 > L1. It’s clear that the longer you delay the study time, the more it builds up and works against you, particularly if you’re working full time like me.

So my approach as a consequence of realising the above, is the below. Of course, this is not the perfect roadmap to passing the CFA L2 exam, but I would stand by it being the most effective way for me that I would encourage others to at least consider if they’re going down this path like me seriously.

I don’t like it when people suggest that the L2 exam is a “beast” compared to the L1 exam. I generally think that the CFAI writes the exams to be as fair as it can be if you are prepared. None of the Qs are rocket science to a person who is diligently and appropriately prepared I would say. After all, this is still just a social science.

Whilst people will say L2 is overly daunting, I genuinely believe the whole experience of studying the 5 months before the exam was more enjoyable and easier when I went with Mark Meldrum as my exam provider (and I’m not getting paid to say this, although I am a customer so take this for what it’s worth).

I think Mark actually charges the cheapest vs all the other typical providers like Wiley, Kaplan, etc. I recall paying ~CAD1000 for level 2 AND level 3 (in one fee to completion). He breaks down every reading of the CFA syllabus (of which there are like ~50 readings in L2) into more digestible 1-2 hour lecture-type videos. He then has a video for virtually every end-of-chapter reading problem set which I found extremely useful listening to his thought process when answering the Qs. It’s not about how many hours you study for the CFA exam but rather, the goal should be focusing on building on your process of learning. It also helps with memory retention!

So all that considered, I did NOT make ANY notes for the CFA L2 exam. The only “notes” I had was the “formula sheet” which summarises the key formulae you’d need for the L2 exam which is provided by Mark Meldrum. Knowing when and where and why to apply all the formulae was really important for me when doing the L2 exam.

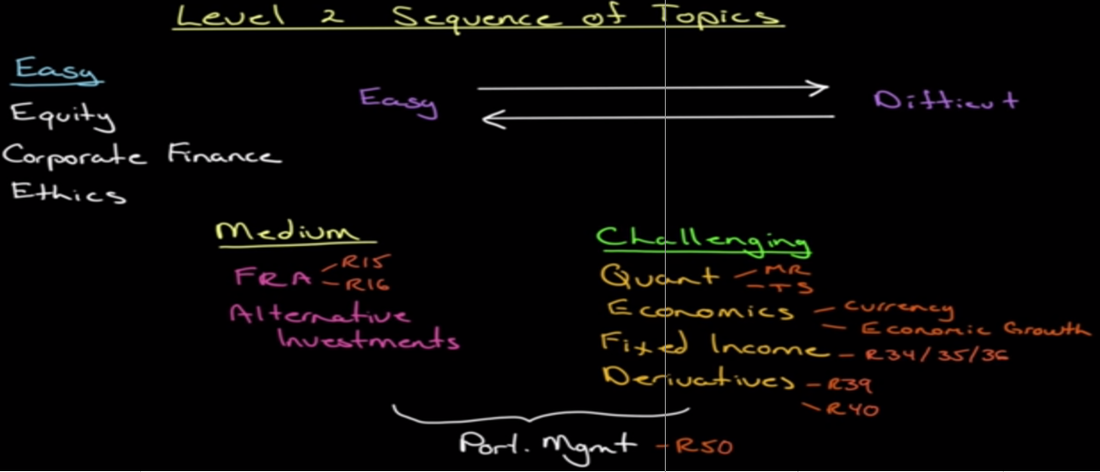

I follow the order that was recommended by Mark in terms of approaching the CFAI L2 readings. Most people who don’t have a prep provider will just read chronologically, but I disagree with this. It’s much better to drill the harder topics first so your brain can passively meditate on them, before dealing with the easier topics. So my order was going from quant > economics > fixed income > derivatives > FRA (financial reporting and accounting) > alternative investments > equity > corporate finance > ethics (ALWAYS leave this last since much of this is unfortunately rote memorisation of what is and is not allowed ethically).

I started ~5 months before my exam, going through each reading video then each relevant end of chapter questions video by Mark Meldrum. Whilst not advised, I did not actually “read” any of the readings at all. I relied on Mark’s videos as the “readings”. That saves you a lot of time. I tried to summarise this process in the simple spreadsheet I made below that helped me track my progress in my studies.

After going through each reading (or “topic” video) then the “EOC” questions video, I went back and watched the “review” videos that Mark provides for all the readings.

I also liked using the “CFA” Reddit page to ask quick questions I was uncertain about. The Reddit page is grossly underestimated, here.

That process above will likely take a solid ~4 months. During the interim, if you can cycle the review videos on the topics you are “less confident” in, that is always a good idea. I reserved like 1-2 hours on a weekend to do that with a topic like derivatives which has some trickier problems with some heavier maths involved.

In the last month, I cycled through all the review videos a 2nd time in the syllabus from start to finish. The last month is NOT about learning, but consolidating knowledge and having broad coverage and understanding of as many topics as I could get my head around.

I took 7 days of study leave before my exam to prepare for my exam. The CFAI provides 2 mock exams. I also sat 2 mock exams that Mark Meldrum provides. I would absolutely recommend doing a few mock exams under exam conditions to get used to the “time” and the “wearing of a mask” in doing an exam in COVID conditions. Back in the paper exam days, it was a 6-hour exam, so it was important to get used to the idea of sitting for that long, although I would note that it is now all computer-based since 2021 (no more paper exams), with the exam length being 4.5 hours, but the usual practice of experiencing the exam conditions a few times before the real exam is vital.

Seems trivial, but very important to practise this. I really only started doing the 4 mock exams in total at ~2 weeks before my exam, making sure to space it out evenly between.

On my last day before the CFA exam, I would go over ensuring I was across all the formulae in that formula sheet provided by Mark Meldrum, and I would go over the ethics content. However, all that said, the last day should be a light review at best and nothing more. It was important for me to get ~7 hours of sleep before exam day, and I would encourage people to figure out their plan for transport to get to the exam the day before and have their writing material, passport, etc ready the day before so you don’t stress about it on exam day.

On exam day, I would encourage aiming to get to the exam at least 30 minutes earlier than what is required so you have time to settle down and also ensure you don’t miss the exam because of some transport delays… The CFAI does not allow “makeup” exams even if you’re sick so yes, be aware of that.

Have a snack and water ready in your bag in between the AM and PM section of the exam. That might seem simple but needs to be said, since I remember people piling up outside the same food stalls to buy food which wastes time. You don’t have a long break time, so you’re better off eating something simple like an apple/bread and just settling down before the PM exam.

At the end of the day, try to enjoy the experience as crazy as it sounds. I think a big part of taking the L2 exam is a positive mindset, much like the other levels. Be thankful you get to learn when many others would love to but cannot due to differing circumstances.

Lastly, follow the exam proctors carefully.

That’s all the serious advice I have off the top of my head for sitting the CFA L2 exam. Feel free to comment below or DM me if I’ve missed anything. Hoping to say a few words on the CFA L3 exam which I sat recently, but there are many other blog posts I want to make in the meantime that is a higher priority so stay tuned. Lemme know if you found my advice helpful!

Good luck to all future CFA candidates who have decided to go down this rabbit hole of a journey with me.

Wishing everybody a good Sunday,

Michael Li